Revolutionizing Commercial Lending: Agentic AI for Efficient Intake, Financial Spreading, and Borrower Data Readiness

Executive Summary

AI is reshaping commercial lending faster than any technology shift in a decade. For CIOs and engineering leaders, the immediate opportunity is to compress cycle times in intake, financial spreading, and borrower data readiness while raising accuracy and auditability. This guide outlines a step by step agentic approach that delivers measurable ROI with controls, compliance, and explainability built in.

Why this moment matters

Legacy lending stacks were not built for unstructured data, fragmented borrower systems, or constant policy change. Agentic AI systems coordinate specialized models to read, extract, normalize, reason, and route decisions with human oversight. The result is a lending operation that is faster, safer, and more transparent than manual processes.

AI in commercial lending workflow overview

This guide focuses on three workflows where agentic AI for lending produces the greatest returns in the first 90 days. Each area includes key steps, common bottlenecks, risks, and the technical design pattern to resolve them.

- Intake: Capture and classify borrower materials across channels, validate completeness, resolve identity, and open cases.

- Financial Spreading: Extract and normalize financial statements, map to a canonical chart, and compute ratios, trends, and anomalies.

- Borrower Data Readiness: Continuously reconcile borrower data across internal and third party sources and flag gaps before underwriting starts.

Part 1. Intake for commercial loan origination

Current workflow

Borrowers and relationship managers submit PDFs, scans, spreadsheets, emails, and portal uploads. Operations staff manually triage files, rename and reclassify documents, and request missing items. SLA breaches and repeat follow ups are common.

Main challenges

- Document chaos: Multiple formats, poor scan quality, inconsistent naming, and version drift.

- Policy drift: Intake checklists differ by product, region, and borrower type with frequent updates.

- Identity and entity resolution: Matching guarantors, affiliates, and legal entities across systems.

- Latency: Queues form during intake spikes, delaying downstream underwriting.

Agentic approach

- Channel connectors: Ingest from email, SFTP, portals, and RM uploads with checksum and PII redaction.

- Document Intelligence Agent: Classify documents, extract key fields, and normalize filenames and metadata.

- Policy agent: Validate required items by product and region using a policy knowledge base.

- Entity resolver: Link borrowers and guarantors to internal IDs and external registries.

- Orchestration: Open a case, generate a borrower checklist, and trigger follow ups with context.

Advantages

- Throughput: 80 to 90 percent auto classification and extraction on day one with human quality review on exceptions.

- Consistency: Policy and compliance-aware AI prevents intake drift and embeds audit trails.

- Fewer touchpoints: Proactive missing item detection reduces RM and borrower back and forth.

Risks and mitigations

- Misclassification risk: Use confidence thresholds, dual model voting, and reviewer queues.

- PII handling: Auto redaction, encryption at rest, and least privilege access.

- Policy updates: Versioned policy artifacts and rollback capability.

Outcome metrics

- Cycle time from first document to complete package, by product.

- Percent of submissions requiring borrower follow up.

- Exception rate by document class and model confidence.

| Intake dimension | Manual process | Agentic AI process |

|---|---|---|

| Document classification | 5 to 10 minutes per file | < 10 seconds per file with human validation on low confidence |

| Checklist enforcement | Spreadsheet and email threads | Policy agent with automatic missing item detection |

| PII controls | Manual masking | Automated redaction and access logs |

Part 2. Financial spreading with AI

Current workflow

Analysts retype or copy paste values from PDFs into spreading templates, reconcile totals, and compute ratios. Differences in borrower accounting categories and presentation formats lead to inconsistency across deals.

Challenges

- Data quality: OCR errors, table detection issues, and multi column layouts degrade accuracy.

- Normalization: Mapping arbitrary statement line items to a canonical chart of accounts.

- Explainability: Need clear traceability from calculated ratios back to source cells.

- Scalability: Spreading becomes the bottleneck during peak deal flow.

Agentic approach

- Extraction agent: Table aware OCR and structure reconstruction for PDFs, scans, and spreadsheets.

- Normalization agent: Map line items to a canonical taxonomy using few shot prompts and rules.

- Computation agent: Calculate ratios, trends, seasonality, and cash flow metrics.

- Explainability layer: Cell lineage, source file references, and confidence per metric.

- Human in the loop: Analysts review low confidence mappings and approve final spreads.

Advantages

- Consistency: Canonical mapping eliminates template drift and enables benchmarks.

- Speed: Spreading hours compressed to minutes, enabling more scenarios per deal.

- Quality: Confidence scores and cell lineage deliver superior auditability.

Risks and mitigations

- Mapping errors: Maintain a supervised mapping memory per borrower and industry.

- Edge cases: Route non standard statements to senior analyst queues.

- Model decay: Scheduled regression tests with gold datasets.

Outcome metrics

- Average time to spread a three year statement package.

- Variance across analysts on the same borrower.

- Rework rate due to mapping corrections.

| Spreading task | Manual | With financial spreading with AI |

|---|---|---|

| Extract multi page tables | 30 to 60 minutes | Under 2 minutes with review |

| Normalize to canonical chart | Analyst by analyst variation | Deterministic mapping with learnable overrides |

| Explainability | Notes in spreadsheets | Automated cell lineage and confidence |

Part 3. Borrower data readiness before underwriting

Current workflow

Teams discover missing or stale data after underwriting begins. External data sources are queried ad hoc, and discrepancies between systems delay decisions and frustrate borrowers.

Challenges

- Fragmentation: Data scattered across CRM, LOS, core systems, and third parties.

- Freshness: Annual statements conflict with latest management accounts and tax returns.

- Completeness: Missing footnotes, schedules, and guarantor attestations.

- Policy alignment: Data required varies by loan type and exposure.

Agentic approach

- Readiness agent: Compares current case data with policy required fields and schedules.

- External data connectors: Pulls business registries, sanctions, liens, and credit bureaus.

- Reconciliation agent: Detects conflicts across sources and proposes resolution paths.

- Borrower co pilot: Generates precise data requests with examples and secure upload links.

Advantages

- Fewer underwriting stalls: Underwriters start with a complete and current package.

- Better borrower experience: Targeted requests reduce effort and confusion.

- Lower risk: Early detection of red flags leads to more informed decisions.

Risks and mitigations

- Third party data drift: Cache with freshness windows and source prioritization.

- Over collection: Enforce data minimization and purpose binding.

- Access control: Attribute based policies tied to deal role and geography.

Controls, compliance, and auditability

AI in commercial lending must meet the same or higher standards than existing controls. A policy and compliance-aware AI uses a versioned knowledge base of product rules, KYC requirements, and document checklists enforced by the orchestration layer.

- Guardrails: Structured prompts, function call restrictions, and deterministic parsers for sensitive steps.

- Human in the loop: Required approvals for low confidence or high impact actions.

- Audit logging: Immutable logs of inputs, model versions, prompts, outputs, and user actions.

- Testing: Red team prompts, fairness checks, and regression suites per model update.

ROI, throughput, and cost profile

It's important to evaluate both efficiency and risk posture. The economics below are representative for a regional lender with a moderate commercial portfolio and a mix of real estate and C&I deals.

| Cost or benefit driver | Manual baseline | Agentic AI outcome |

|---|---|---|

| Intake cycle time per deal | 3 to 5 days | < 24 hours for complete packages |

| Analyst hours for spreading | 4 to 8 hours | 0.5 to 1.5 hours with review |

| Borrower requests per deal | 6 to 10 back and forth | 2 to 3 targeted requests |

| Rework rate | 10 to 20 percent | 3 to 7 percent with confidence gating |

| Compliance exceptions | Spreadsheet driven controls | System enforced policies with audit trail |

Typical payback periods range from 3 to 6 months when focusing on commercial loan intake automation and spreading first, with borrower data readiness yielding additional benefits as external data connectors mature.

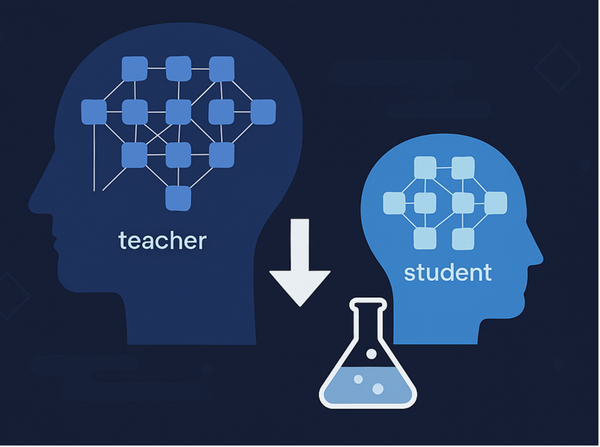

Putting it all together with agentic AI for lending

Adopt a layered architecture where specialized agents handle intake, spreading, and readiness while policy and human review enforce governance. This structure minimizes risk, accelerates deployment, and creates reusable components across products and regions. Over time, the same stack powers portfolio analytics, early warning, and workflow automation.

How Agami helps accelerate outcomes

Agents

Document Intelligence Agent

Extract and normalize data from any document such as PDFs, scans, spreadsheets, or images, and make it instantly usable for downstream AI workflows. In intake, it delivers high precision classification, table aware extraction, PII redaction, and metadata normalization. In spreading, it reconstructs statement structure and maps fields into your canonical chart with confidence thresholds and reviewer routing.

Insights Agent

Transform structured and unstructured data into actionable insights, benchmarks, and risk alerts for faster decisions. For borrower data readiness, it reconciles internal and external sources, highlights anomalies, and surfaces policy gaps before underwriting begins. It also powers risk insights for commercial lenders by scanning spreads, covenants, and sector trends to produce alerts and recommendations.

Next steps

If you want to validate the impact on your own documents, templates, and policies, schedule a working session with your architecture and risk teams. We will map pilots to your controls and deliver measurable outcomes in weeks, not quarters. Talk to Us.

Frequently Asked Questions

1. How is AI transforming commercial lending?

AI is reshaping commercial lending by automating workflows such as intake, financial spreading, and borrower data readiness, resulting in faster processes, improved accuracy, and greater compliance.

2. What are the main challenges in the commercial loan intake process?

Key challenges include document chaos from multiple formats, policy drift due to frequent updates, identity resolution of borrowers and guarantors, and latency during intake spikes.

3. What benefits does agentic AI provide in financial spreading?

Agentic AI enhances financial spreading by reducing time to process multi-page statements, ensuring consistent data mapping to a canonical chart, and providing clear traceability for auditability.

4. Why is borrower data readiness crucial before underwriting?

Borrower data readiness is essential to avoid delays by ensuring complete and up-to-date information is available, which enhances decision-making and improves the borrower experience.

5. How can organizations measure the success of AI in their lending operations?

Success can be measured through outcome metrics such as cycle time from initial document submission to a complete package, the percentage of submissions requiring follow-up, and the exception rate by document class.

6. What role does compliance play in AI-driven commercial lending?

Compliance is integral in AI-driven lending, as AI systems must meet or exceed existing controls, using a policy-aware framework that enforces rules and maintains audit trails for accountability.