Unlocking the Potential: Top 3 AI Use-Cases in Commercial Lending

AI is no longer a pilot experiment. It is rapidly redefining how commercial lending teams assess risk, move files, and make decisions. For leaders who own credit quality and throughput, the question is how to harness AI to improve margin, control, and speed.

Top 3 workflows that matter the most right now

Credit organizations are under pressure to shrink decision cycles while maintaining pristine controls. The friction sits in a few work-heavy workflows that depend on unstructured data, policy interpretation, and repeatable judgment. Focusing AI where both volume and variability are high delivers the fastest ROI and the strongest governance uplift.

AI in commercial lending for three critical workflows

Workflow 1: Intake, financial spreading, and borrower data readiness

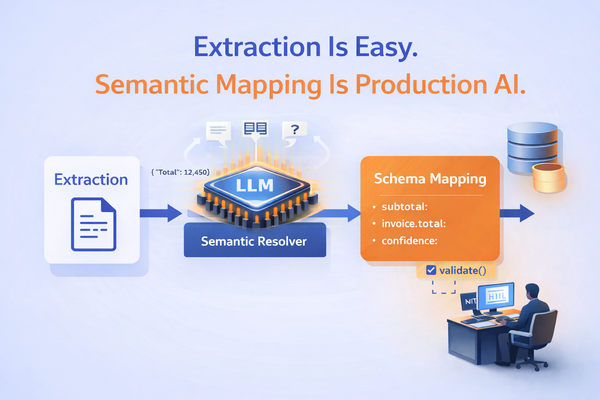

Underwriting begins with messy documents. Borrowers and accountants send PDFs, scans, spreadsheets, and images that require normalization before analysis. The bottleneck is financial statement extraction, cross-period mapping, and the assurance that nothing material is missed.

Financial statement extraction AI can turn raw statements into clean line-item data, including schedules, footnotes, and off-balance sheet disclosures. It flags gaps, detects inconsistent period coverage, and preserves source references for audit. For Heads of Credit, this means faster spreads with traceability that satisfies internal audit and regulators.

Beyond speed, the key is data quality. AI agents can reconcile borrower, guarantor, and affiliate entities, align chart of accounts to your spreading taxonomy, and auto-enrich with industry codes or collateral descriptors. The output is analysis-ready and policy-aligned, with every figure tied back to the page, cell, or image origin.

- Cycle time reduction: 50 to 80 percent for initial spreads.

- Rework reduction: 30 to 50 percent fewer exceptions from credit review.

- Auditability: 100 percent lineage from numeric output to document evidence.

Workflow 2: Credit memo drafting, policy checks, and committee readiness

Drafting a committee-ready credit memo consumes time across underwriting, portfolio management, and risk. Analysts collect data, write narratives, paste charts, and verify policies line by line. Inconsistent structure and tone slow approvals and cause avoidable committee questions.

Credit memo automation powered by policy-aware AI agents standardizes structure and elevates clarity. These agents assemble executive summaries, business descriptions, financial analysis, covenants, and risk mitigants using templates embedded with your credit policy. They also insert charts and peer benchmarks, while highlighting any variance from policy for explicit approval.

For senior reviewers, this means better comparability across files and fewer cycles to align on risk grade and structure. It also shortens the time to close and improves confidence that memos reflect institutional standards and the latest underwriting guidance.

- Draft-to-approve time: 30 to 60 percent faster with fewer redlines.

- Consistency: 90 percent+ adherence to memo templates and policy clauses.

- Transparency: Inline citations to sources and policy sections for each claim.

To go deeper on implementation routes and policy integration, Talk to Us.

Workflow 3: Covenant setup, continuous monitoring, and portfolio surveillance

After closing, lenders rely on accurate covenant setup and ongoing monitoring across a large volume of borrowers. Traditional processes are manual and periodic, which delays the detection of risk drift. Data lands late from borrowers, and signals hide in emails, filings, and market data.

Covenant monitoring AI can ingest covenant terms from executed documents, translate them into machine-readable rules, and assess compliance as new data arrives. Combined with AI for covenant compliance monitoring, teams can move from periodic checks to continuous surveillance that is proactive and explainable.

Portfolio risk insights become sharper when the same system correlates borrower events, industry trends, collateral price movements, and macro indicators. The outcome is timely early-warning signals in loan portfolios, with ranked alerts and evidence trails that help Risk Ops act before problems become losses.

- Breaches detected pre-rollover: 2 to 4 quarters earlier on average.

- Manual tracking effort: 40 to 70 percent reduction across portfolio managers.

- False positive rate: Reduced via multi-signal confirmation and borrower outreach drafts.

What strong controls look like with AI

For Heads of Lending and Compliance Leads, controls matter as much as speed. Modern AI systems enforce least-privilege data access, record every transformation, and preserve immutable links back to source documents. They also align output to your credit policy and regulatory obligations.

Policy-aware AI agents make every judgement auditable. They produce rationales for classifications, surface policy conflicts, and require human sign-off where thresholds are crossed. This ensures the line between automation and judgment is explicit and defensible.

- Data lineage and evidence: Every number traced to a page, cell, or field with time stamps.

- Model risk controls: Versioned prompts and models, with challenger models for sensitive steps.

- Access and privacy: Segmented environments, role-based controls, and private model routing.

Quantified outcomes you can expect in 90 days

Leaders evaluating AI in commercial lending should tie pilots to measurable results. A well-scoped deployment can cut end-to-end underwriting time without compromising risk quality. The following are typical outcomes in the first quarter of rollout.

- Underwriting throughput: 25 to 40 percent increase with existing headcount.

- Credit memo production time: 35 to 60 percent reduction while improving standardization.

- Covenant monitoring coverage: 100 percent of in-scope covenants tracked continuously.

- Exception rates: 20 to 40 percent fewer rework cycles from credit review or committee.

- Loss avoidance: Earlier alerts drive targeted outreach and remediation plans.

Ready to see this in your workflow stack and policy context? Talk to Us for a tailored walkthrough.

Implementation path with minimal disruption

Execution should align to your risk appetite and change management cadence. Start with a clearly bounded product or segment, then expand as controls and trust build. Most lenders can deliver value without replacing core systems.

Step 1: Define scope and success metrics

Select one of the three workflows and define operational and risk metrics up front. Examples include spread time, memo cycle time, alert precision, and exception counts. Map your policy artifacts and templates that the AI should observe.

Step 2: Connect documents and data sources

Ingest statements, borrower files, and credit policies from your DMS and data warehouse. Preserve silos where required by confidentiality and use private model routing for sensitive content. Enable write-back to your credit or portfolio systems when ready.

Step 3: Human-in-the-loop and QA rituals

Establish review checkpoints that are proportional to risk. Use side-by-side comparison views, evidence links, and audit logs so reviewers move faster and with more confidence. Capture every correction to retrain and improve the agent behavior.

Step 4: Scale across segments and regions

Roll out to adjacent product lines once metrics stabilize. Reuse templates, policy packs, and benchmarks to expand coverage without rework. Monitor model performance and recalibrate as data shifts.

Where AI in commercial lending delivers ROI

Return on investment is strongest where document variability, policy complexity, and decision volume intersect. AI excels at extracting structured data from unstructured sources, applying policy logic, and summarizing tradeoffs for human approval. The result is fewer handoffs, faster cycle times, and improved risk visibility across the portfolio.

For executive teams, these gains convert to lower cost per decision and higher banker capacity for client engagement. For risk, they translate to earlier detection, consistent documentation, and defensible decisions. This is why AI in commercial lending is moving from pilots to production in leading institutions.

How Agami enables these workflows with private, policy-aligned AI

Agents

Document Intelligence Agent

Extract and normalize data from any document, including PDFs, scans, spreadsheets, or images, then route it into downstream workflows. In underwriting, it powers financial statement extraction AI across tax returns, compiled statements, bank statements, and collateral schedules. It preserves line-by-line evidence and provides variance checks across periods for faster, higher-quality spreading.

For covenant setup, it reads executed agreements, identifies covenants and definitions, and structures them into machine-readable rules. This reduces manual coding errors and accelerates the transition from close to monitoring.

Research Agent

Combine internal knowledge with trusted external sources to generate accurate, comprehensive research. For credit memos, it enriches borrower narratives with peer benchmarks, industry outlooks, and market signals. It also builds comparable sets and pulls regulatory or legal updates relevant to the borrower’s sector.

The result is committee-ready context with references, so reviewers can verify sources in one click. This complements automate credit memos with AI initiatives by ensuring every claim is substantiated.

Document Composer Agent

Assemble polished reports and memos automatically from structured data and templates, ensuring speed and compliance. In commercial lending, it drives credit memo automation with policy-aware AI agents that apply your templates and credit standards. It flags deviations, inserts required disclosures, and creates both banker and committee versions with the right level of detail.

It can also draft borrower outreach for covenants, renewal notices, and variance explanations, saving hours of repetitive writing while preserving voice and compliance.

Insights Agent

Transform structured and unstructured data into actionable insights, benchmarks, and risk alerts for faster, evidence-based decisions. For monitoring, it powers covenant monitoring AI with rules engines and anomaly detection, reducing noise and surfacing true risk. It generates portfolio risk insights that rank borrowers by emerging risk factors and propose next actions with evidence.

This is where early-warning signals in loan portfolios become operational, helping Risk Ops intervene ahead of negative migration or breaches.

Put it to work in your credit stack

Whether your priority is faster spreads, consistent memos, or continuous monitoring, the path to value is clear. Start small, measure rigorously, and scale where the gains and controls are strongest. This is a pragmatic playbook for leaders ready to operationalize AI in commercial lending.

If you want a private, policy-aligned approach proven in regulated settings, Talk to Us.

Frequently Asked Questions

1. How can AI improve the commercial lending process?

AI enhances commercial lending by streamlining workflows such as financial data extraction, credit memo drafting, and covenant monitoring, leading to faster decision cycles and improved data accuracy.

2. What are the key workflows AI optimizes in commercial lending?

AI optimizes workflows in intake and financial data preparation, credit memo drafting and review, and continuous monitoring of covenants and portfolio risk.

3. What benefits can I expect from implementing AI in underwriting?

Implementing AI in underwriting can result in a reduction of cycle times by 50 to 80 percent, fewer rework cycles, and greater audit transparency due to traceability back to source documents.

4. How does AI ensure compliance in commercial lending?

AI maintains compliance by enforcing least-privilege access controls, providing audit trails, and integrating policy-aware agents that align outputs with credit policies and regulatory requirements.

5. What outcomes can I expect in the first 90 days of using AI in lending?

In the first 90 days, you can expect a 25 to 40 percent increase in underwriting throughput, a significant reduction in credit memo production time, and 100 percent continuous tracking of in-scope covenants.

6. Is AI accepted by regulators in the lending process?

Yes, regulators accept AI-driven processes as long as there are explicit controls in place, including evidence trails, policy alignment, and clear human accountability for material decisions.